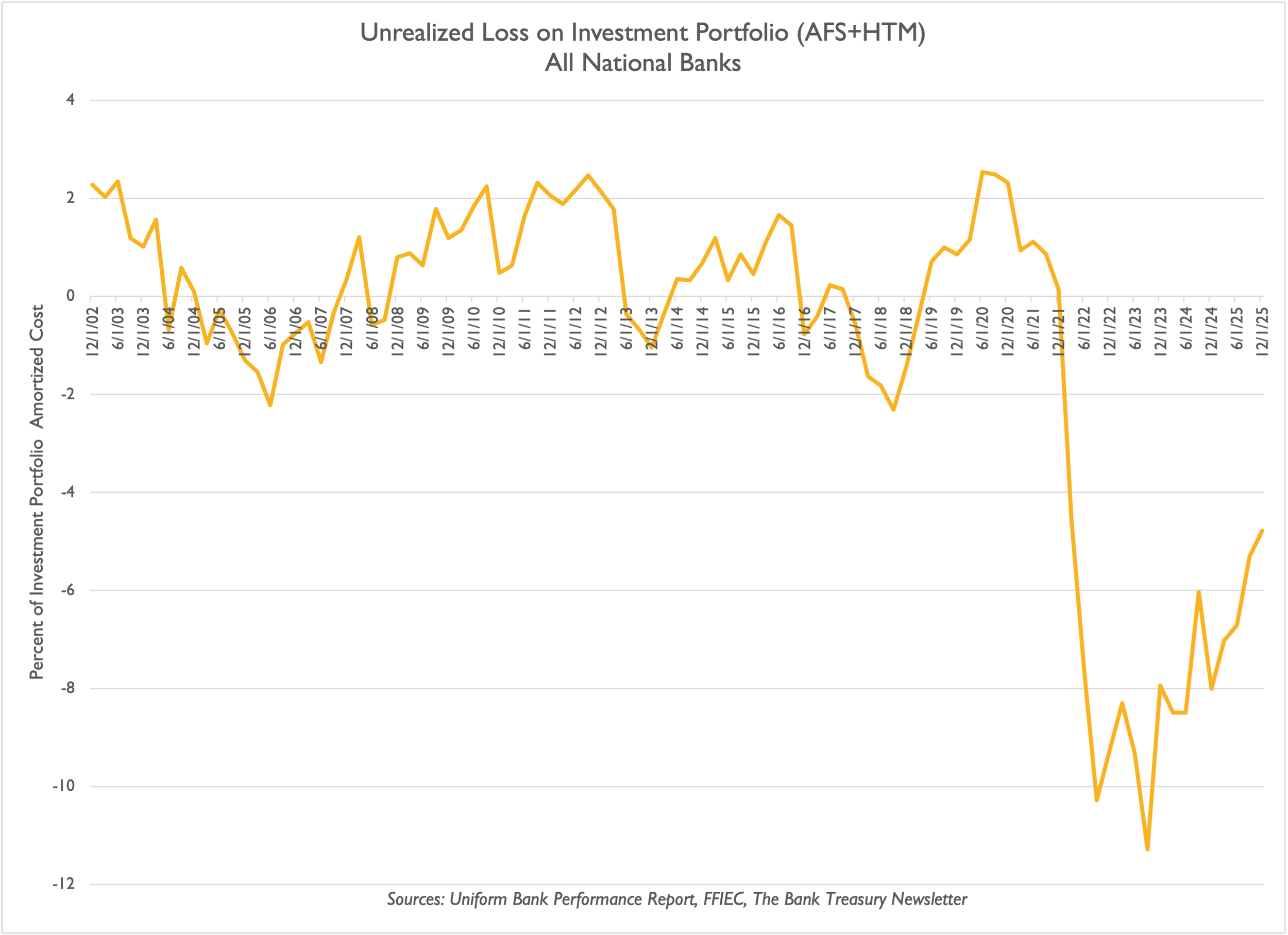

Metropolitan Bank and Trust last month became the first bank of the year to fail, and at the end of last year, reported that unrealized losses in its available-for-sale (AFS) portfolio (the bank did not hold any bonds in held-to-maturity (HTM)) exceeded 100% of its Tier 1 capital. As highlighted in this month’s newsletter, there are 23 banks with total assets under $10 billion that have unrealized market losses in their bond portfolios exceeding 30% of their regulatory capital. However, the first slide in this month’s chart deck shows that the industry continues to climb out of the negative accumulated other comprehensive income hole they fell into three years ago when the Fed went hard and fast, raising interest rates, which caused Silicon Valley Bank to fail.

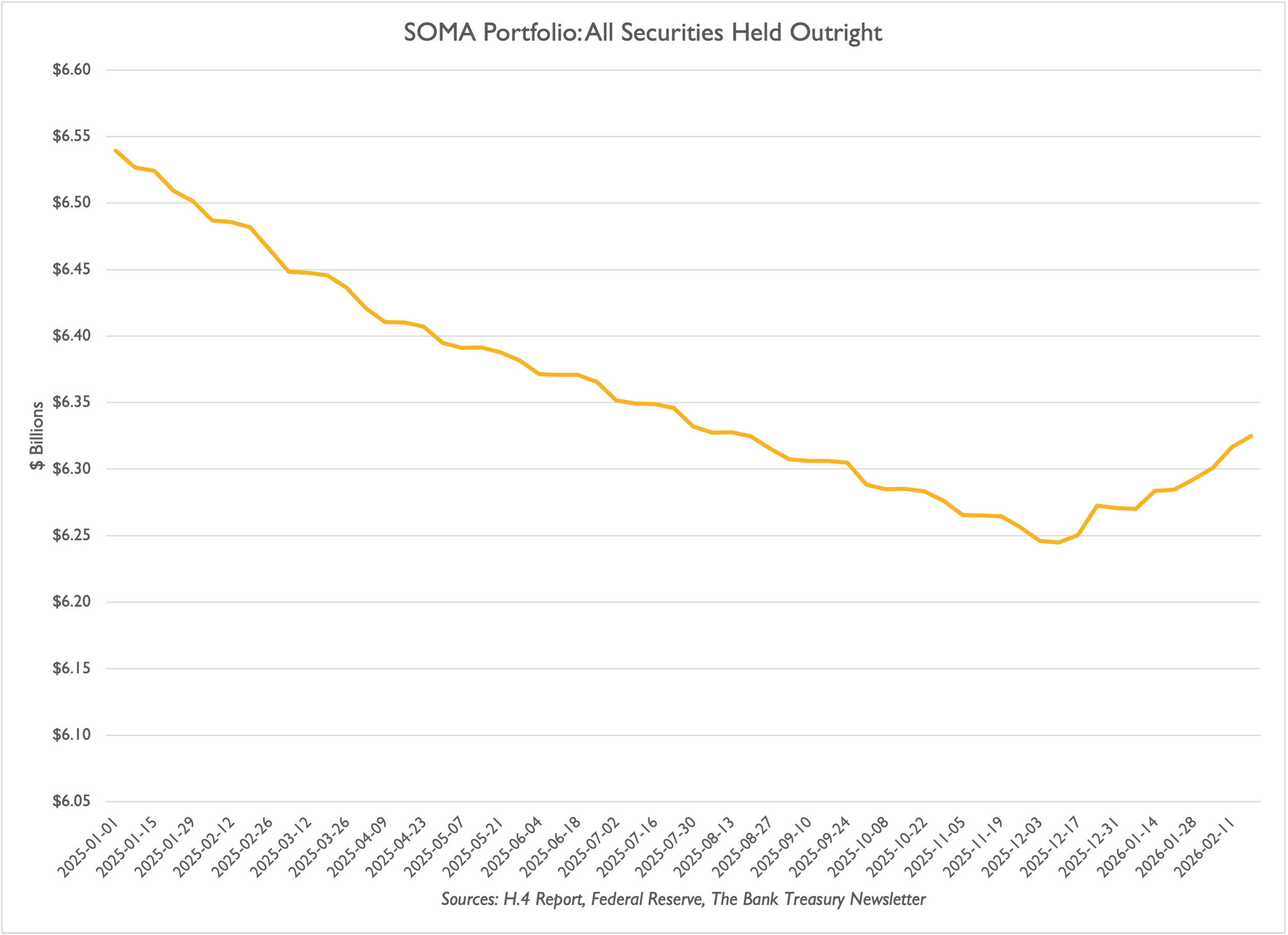

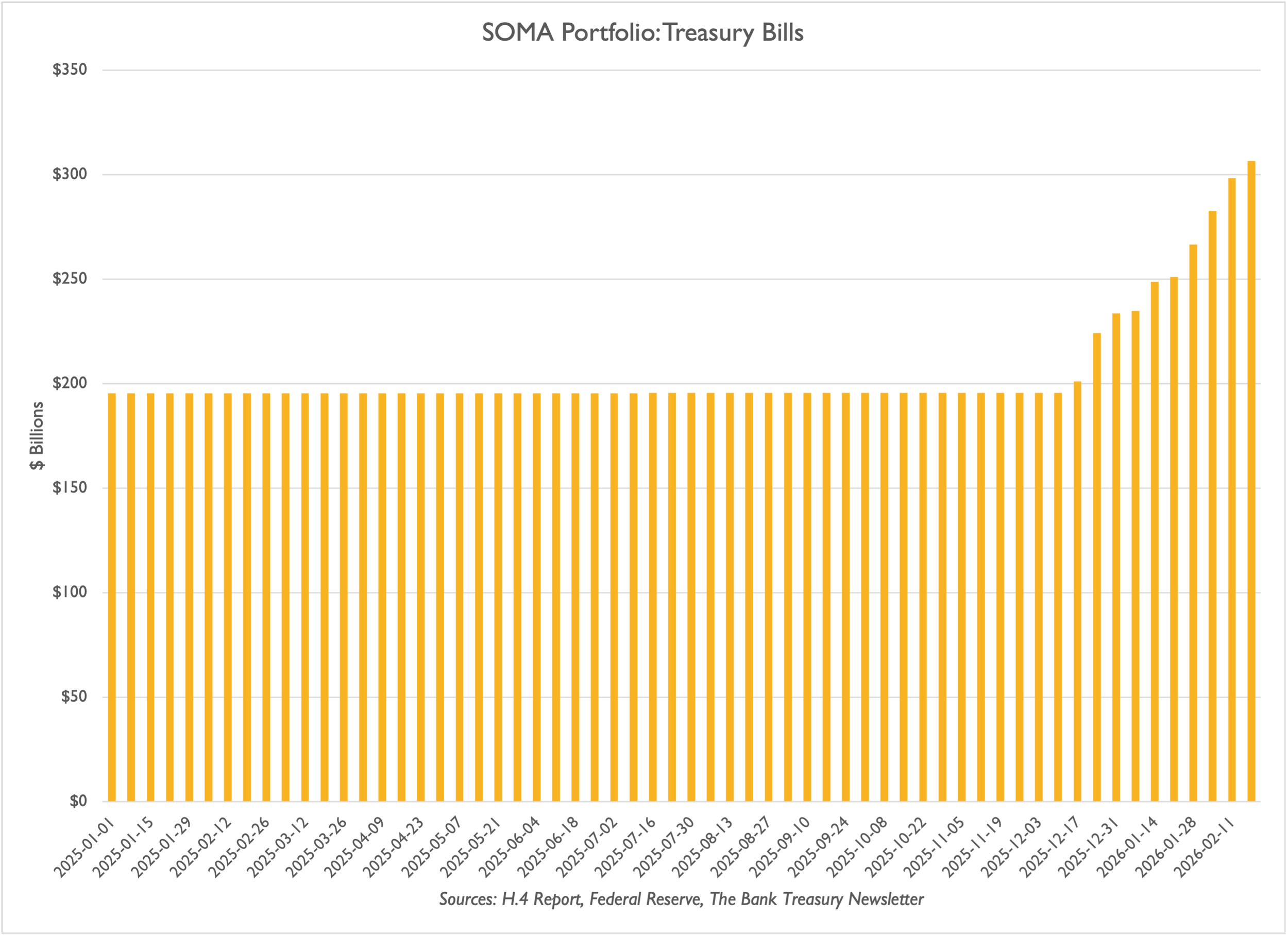

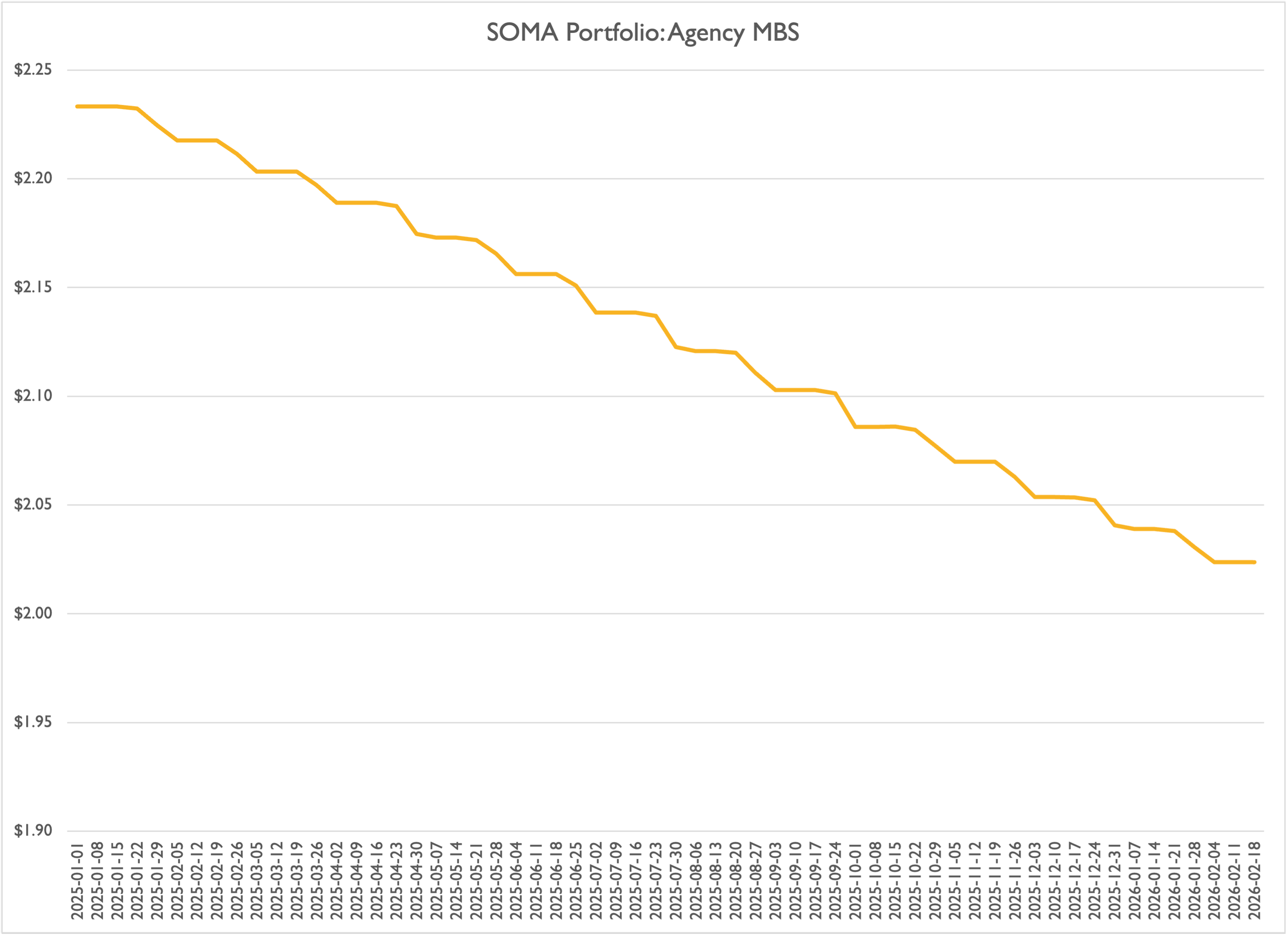

Former Fed governor Kevin Warsh, the President's nominee to chair the Fed, is not a fan of the Fed's balance sheet size and has suggested he would work toward a new Treasury Accord to reduce it. However, the balance sheet today leaves little room for shrinking it. Indeed, its System Open Market Account (SOMA) portfolio began growing again this year (Slide 2), driven by the Fed's decision to expand its holdings of Treasury Bills (Slide 3), which is offsetting the run-off from its Agency MBS holdings (Slide 4).

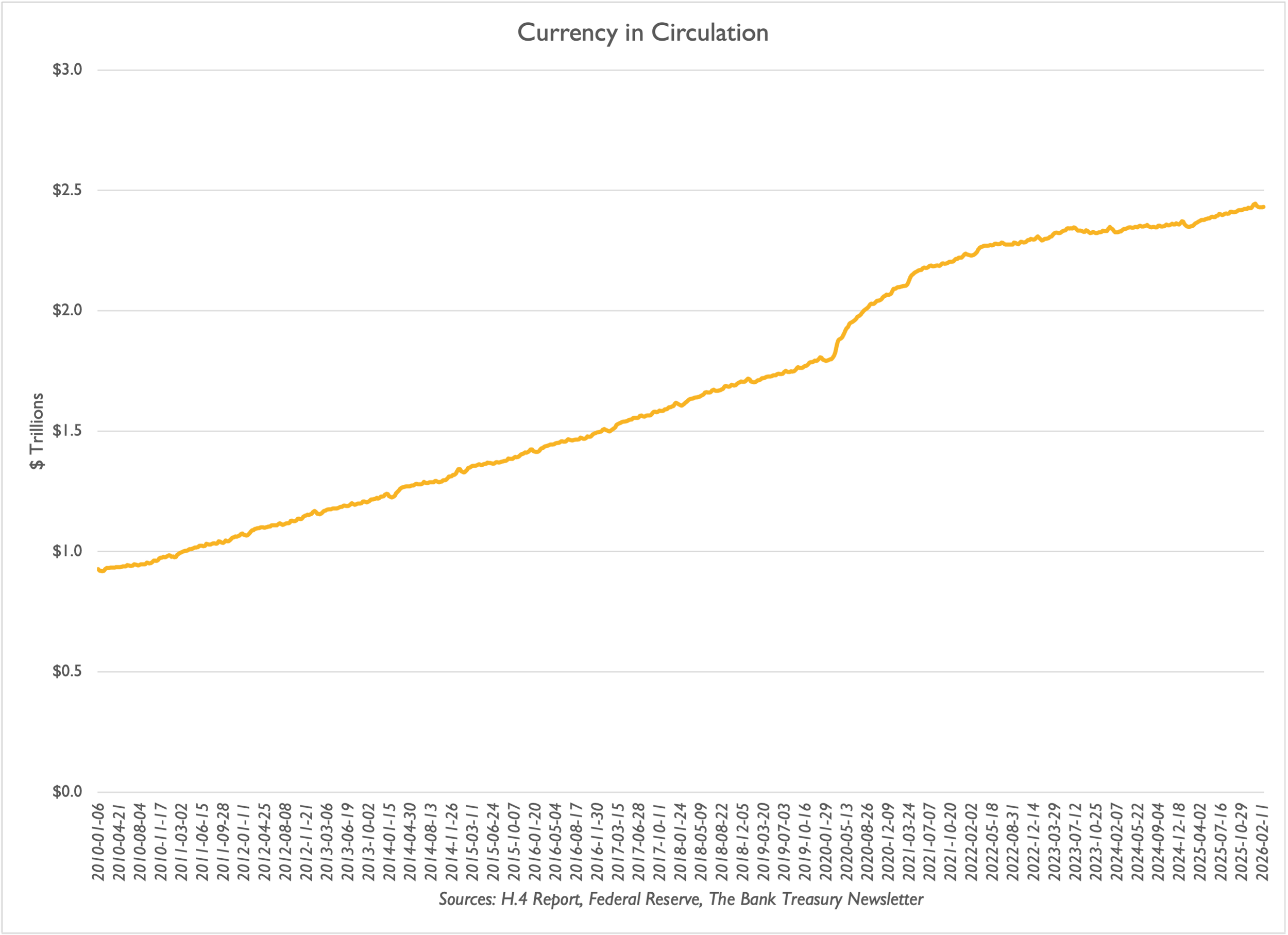

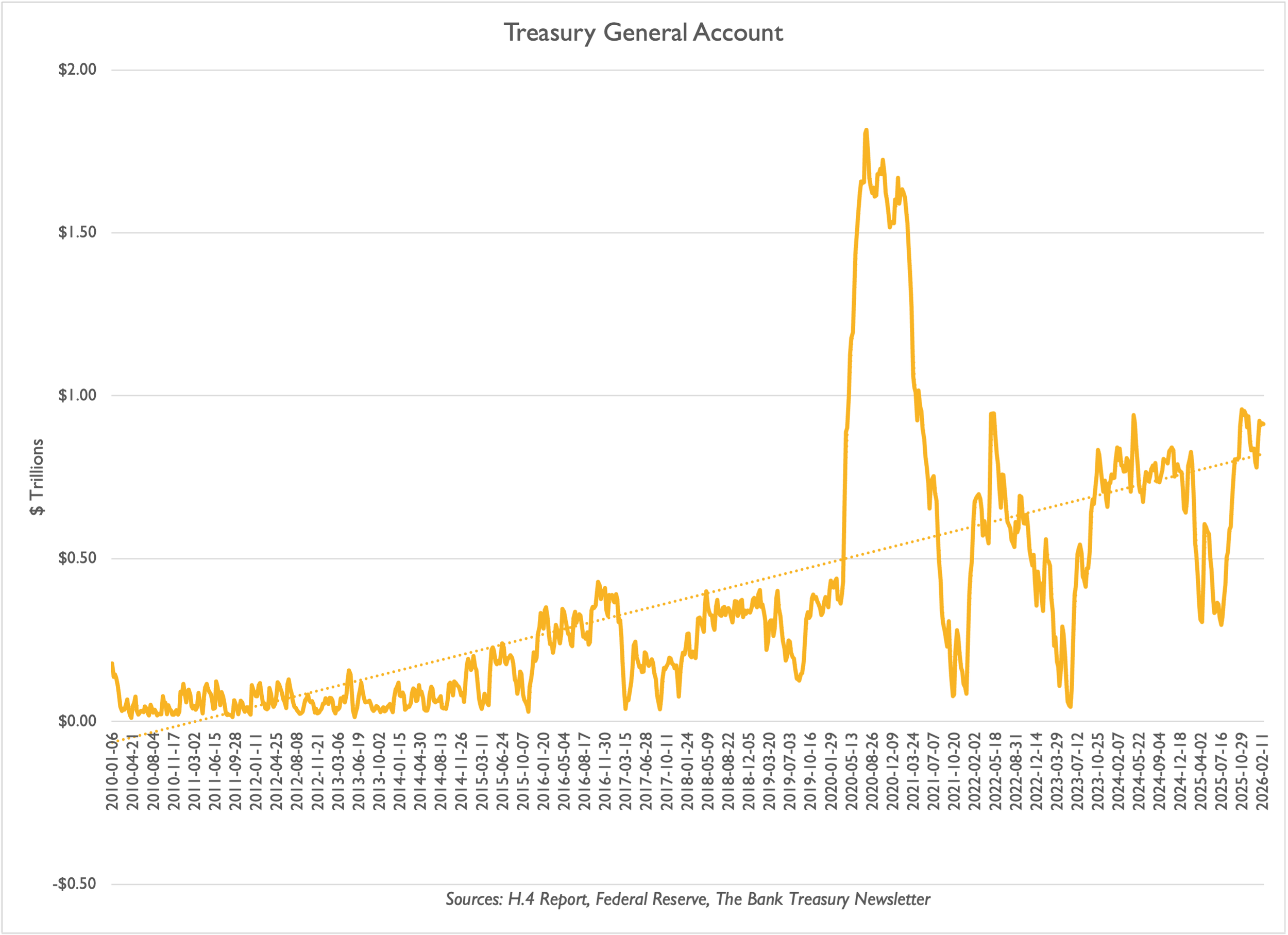

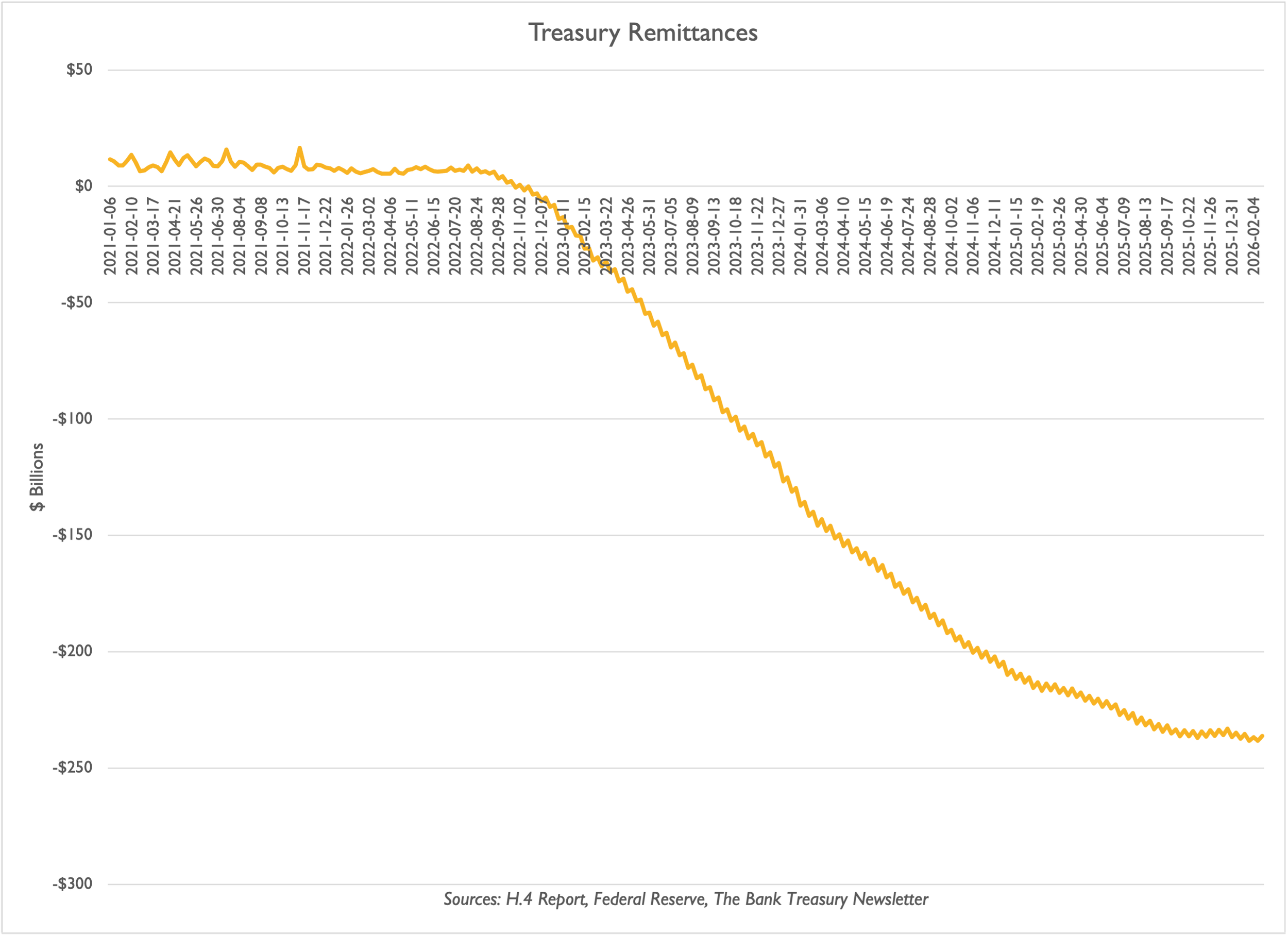

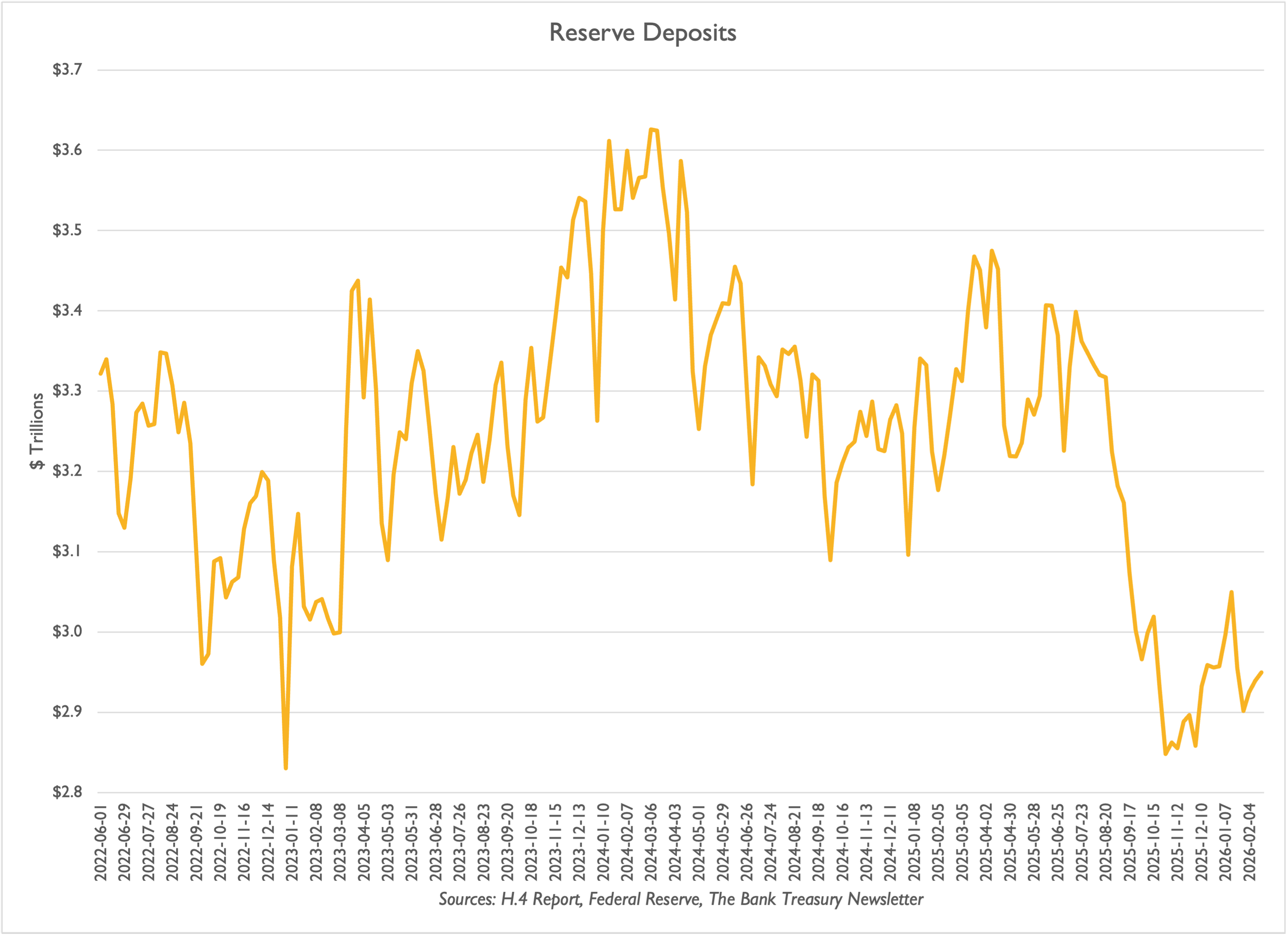

But even if the Fed were not rebuilding its SOMA portfolio by buying Treasurys, the composition of its liabilities would leave it with little room to reduce assets because the liabilities that balance its $6.3 trillion SOMA portfolio include currency in circulation (Slide 5), which this year surpassed $2.4 trillion. Over the past 15 years, since Kevin Warsh resigned as a Fed governor, the average balance in the Treasury's "checking" account at the Fed (Treasury General Account (TGA)) has grown from less than $100 billion to surpassing $900 billion this month (Slide 6). It still earns less on its SOMA portfolio than it pays interest to banks for their reserve deposits, which cumulatively added nearly $240 billion to reserve deposits (Slide 7) through negative Treasury remittances. Even with the offset, higher-trending balances in the Treasury's TGA account, especially over the last six months, explain why reserve deposits (Slide 8) are down since the summer to their lowest level since the Fed began quantitative tightening in June 2023.

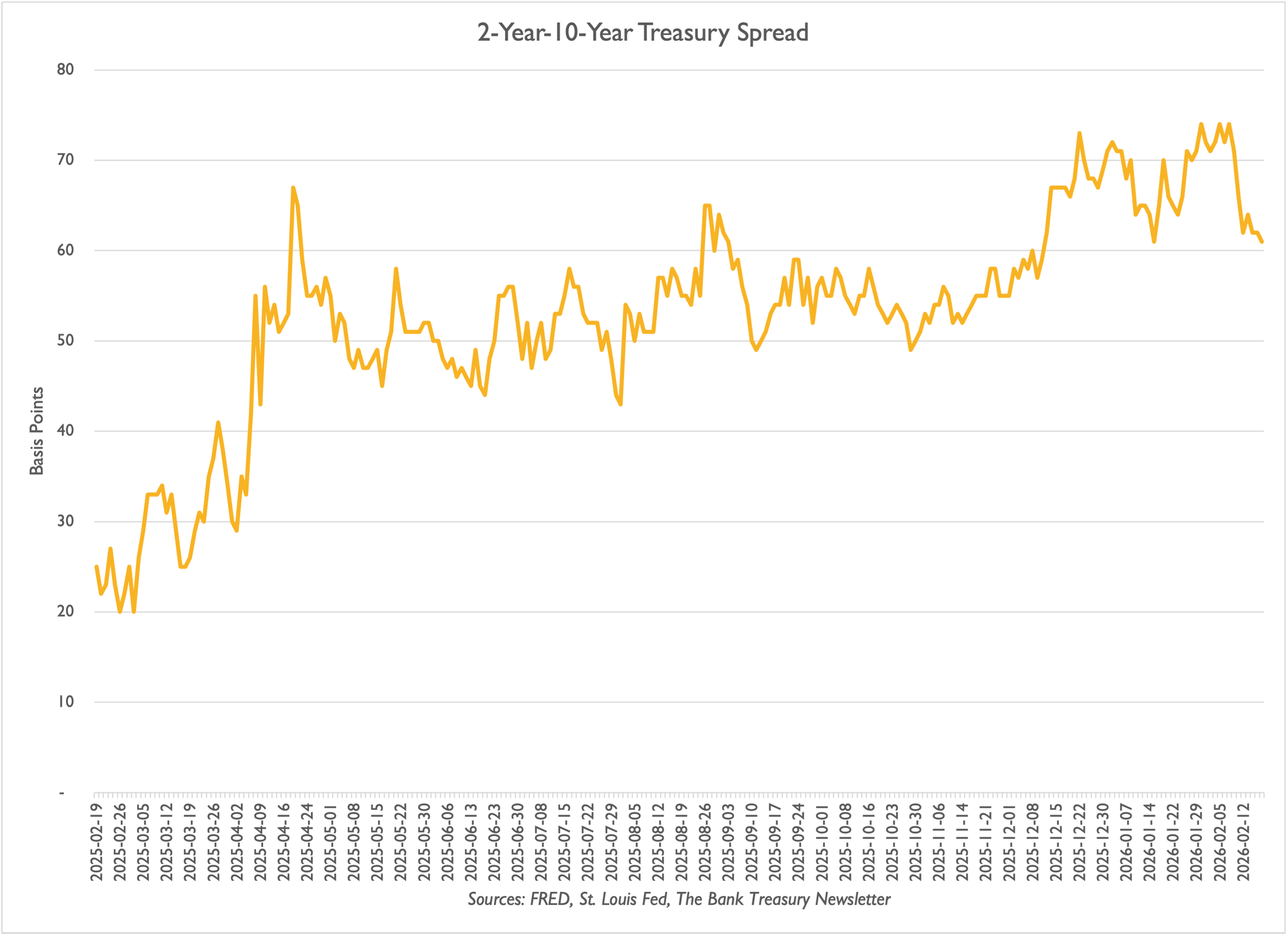

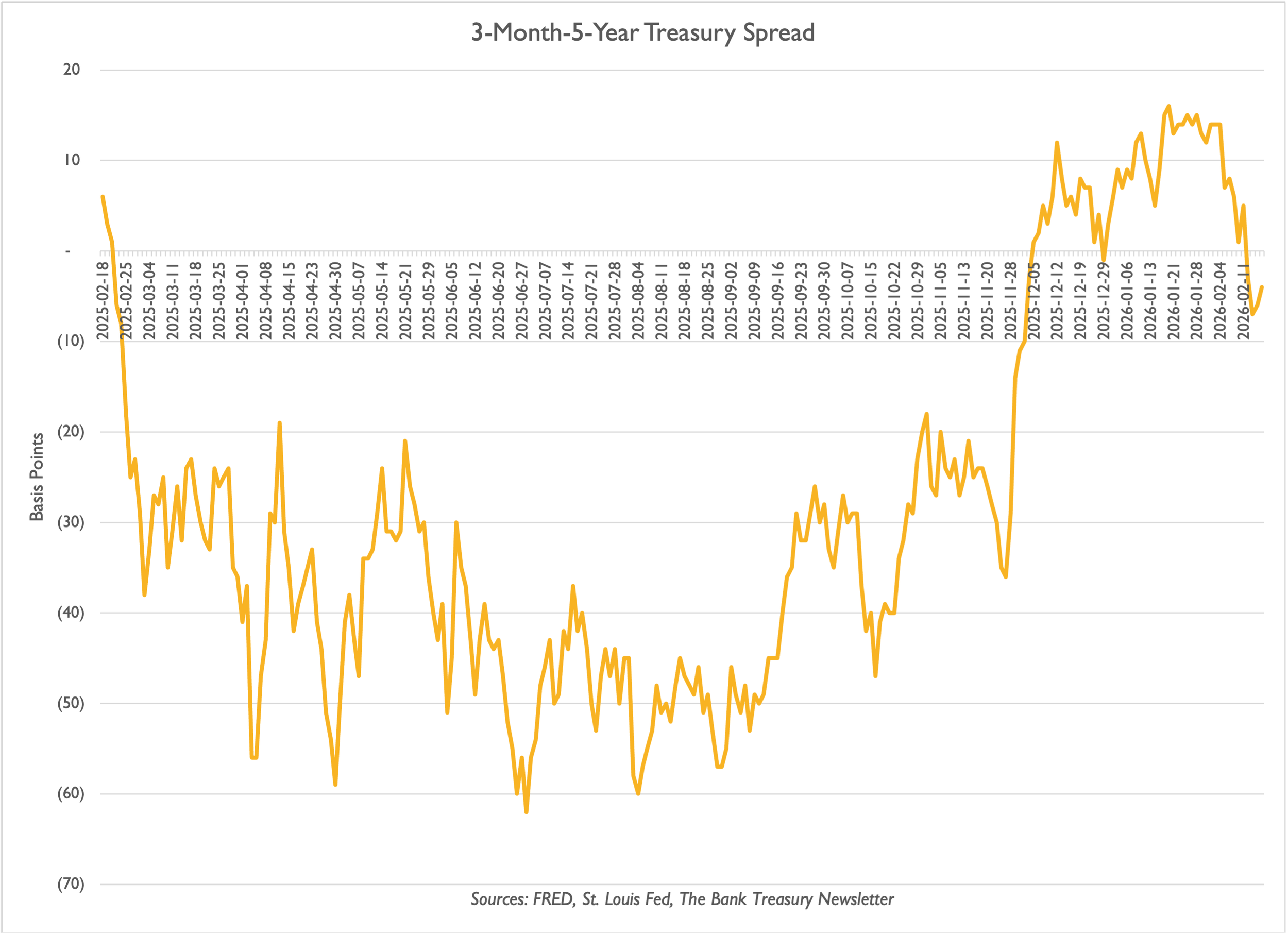

Economic weakness and persistent inflation above the Fed’s 2% target are keeping bank treasurers confused about the direction of interest rates. While initially steepening at the beginning of last year, the 2s-10s spread has remained locked in a narrow range around 60 basis points for most of the past year (Slide 9) as market participants try to divine the future path of interest rates. In contrast to the positively, yet modestly, sloped 2s-10s curve, the 3-month-5-year curve spread began the year flat, then immediately inverted and remained so up until December, when it turned briefly and became barely positive, hitting 10 basis points before falling back into negative territory again this month.

Long Climb Left To Get Out Of Negative AOCI

QE3?

Fed Ramps Up Its T-Bill Holdings

T-Bills Are Replacing Agency MBS Run-Off

Basic Accounting: Higher Cash = Higher SOMA

Treasury Is Holding More Cash In Checking

Negative Remittances Add To Reserve Deposits

TGA Puts Downward Pressure On Reserves

Interest Rate Uncertainty Flattens 2s-10s

3-Month-5-Year Back To Inverted Territory

The Bank Treasury Newsletter is an independent publication that welcomes comments, suggestions, and constructive criticisms from our readers in lieu of payment. Please refer this letter to members of your staff or your peers who would benefit from receiving it, and if you haven’t yet, subscribe here.

Copyright 2026, The Bank Treasury Newsletter, All Rights Reserved.

Ethan M. Heisler, CFA

Editor-in-Chief